Zero, it’s not just you. Insights traditional as opposed to federal homes administration (FHA) loans can feel such understanding various other words. Throw-in terms and conditions particularly private mortgage insurance, debt-to-money rates, appeal accrual and you can insurance costs and you can out of the blue you then become for example getting in touch with supply Fannie and you can Freddie a piece of your face.

Expertise those two home mortgage solutions is paramount to while making an told decision. Let’s falter new ins and outs of antique in the place of FHA money so you’re able to getting empowered in selecting the proper financing to suit your monetary health.

What exactly are FHA Funds?

Government Housing Management (FHA) financing is home loans insured because of the authorities. Generally speaking, it’s home financing style of allowing people who have straight down credit ratings, reduced down repayments and you will more compact earnings to still be eligible for financing. Therefore, FHA money become attractive to earliest-time homeowners.

The purpose of FHA mortgage loans will be to broaden entry to homeownership into the Western personal. When you find yourself FHA funds is covered of the federal company that it shares its identity, you still work with an enthusiastic FHA-recognized personal bank so you’re able to procure that it financial types of.

Just what are FHA Mortgage Criteria?

Yearly, the fresh new Government Casing Government, including a slew of helping government providers, publishes its step 1,000-plus-web page FHA loan manual.

In the event the government loan guides (otherwise is always to i say manifestos) never build your discovering list cut, nothing wrong. There is summarized the major FHA loan standards applicable in order to the current prospective homebuyers:

- Mandatory FHA financial insurance coverage: Consumers having FHA fund might also want to spend FHA mortgage insurance policies. Which have old-fashioned fund, mortgage insurance is recommended and just compulsory should your deposit was less than 20 percent of one’s residence’s well worth. Although not, this rule are a reduced amount of an effective gotcha strategy and much more regarding an industry stabilizer, because the FHA financial insurance policies talks about your own bank for folks who become defaulting on your own financing.

- Required minimal off repayments: FHA financing qualifiers pay down payments partially dictated by credit rating. Credit scores toward budget of spectrum normally want a ten percent advance payment. Mid-diversity so you’re able to higher credit ratings generally speaking have the ability to set-out up to 3.5 per cent.

- Debt-to-earnings (DTI) ratio: DTIs assess the amount of money you may spend per month into the bills than the your full earnings. To safe a keen FHA loan, qualifiers normally have a great DTI away from 31 to 50 %. Basically, the lower new DTI, more competitive this new debtor.

- No. 1 house: Every characteristics a purchaser plans to explore their FHA financing on the need to be believed the first host to household, maybe not a holiday or leasing possessions.

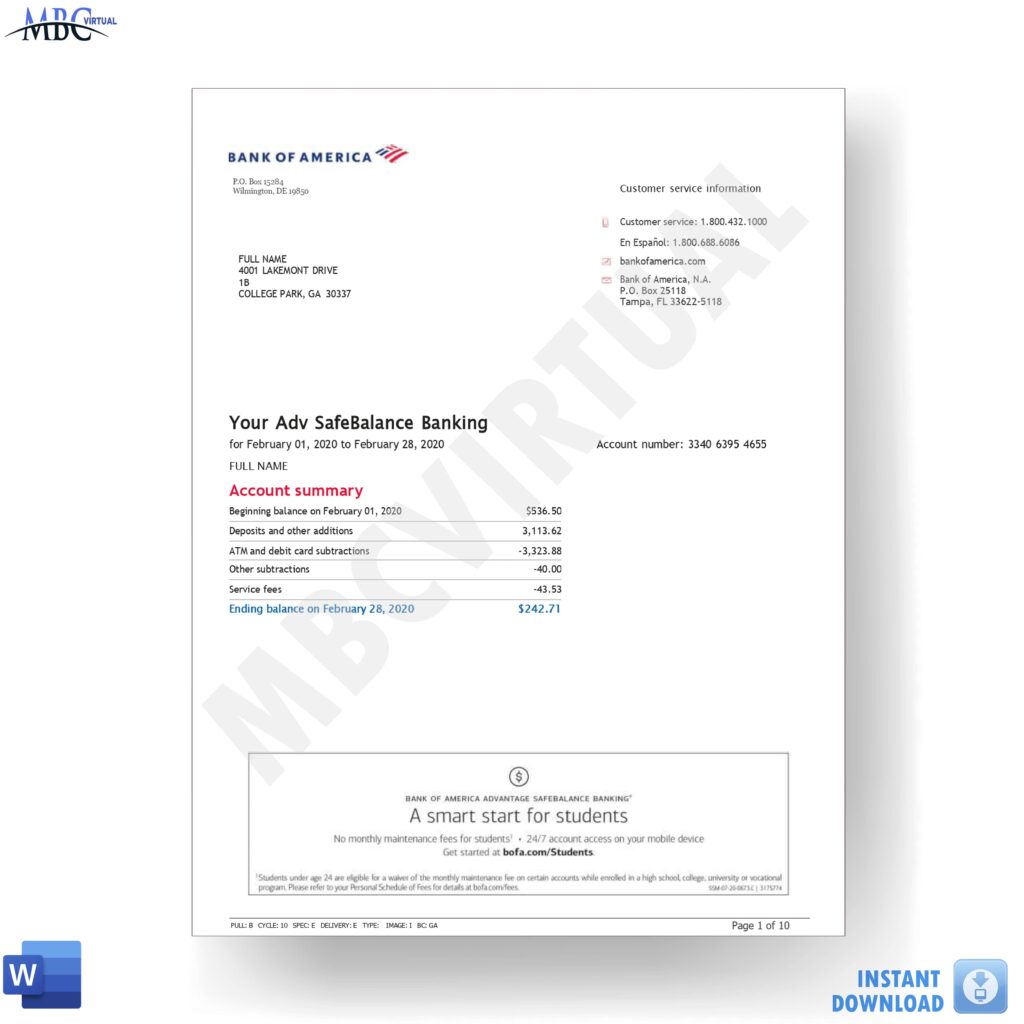

- Proven a career, income: Like most loan products, you must bring no less than 2 yrs of employment history or verifiable money in order to be eligible for a keen FHA loan. (Imagine spend stubs, federal tax statements or bank comments among others.)

Note: FHA’s compulsory home loan insurance need borrowers to invest none however, one or two mortgage insurance costs: Initial superior and annual advanced.

- Initial financial top: Currently, upfront insurance premiums getting FHA funds are a small percentage out-of the installment loans in Los Angeles TX with bad credit entire amount borrowed. It is paid whenever debtor receives their mortgage.

- Annual home loan premium: Such as for example upfront financial insurance fees, yearly home loan insurance costs are determined centered from a tiny part of the complete loan amount.Yet not, parameters particularly loan words (15 or 3 decades) plus dictate rates. Which advanced is actually paid month-to-month, which have installment payments determined by using the latest premium rate and you will isolating it from the 12 months.

Almost every other Inquiries to look at Before getting an FHA Financing

FHA money are made to be a very big pathway in order to homeownership. Its underwriting requirements was aimed toward buyers just who may not have generally financial-glamorous credit scores otherwise revenues but could however confirm limited liability.