Prior to other forms out-of credit, interest rates will be higher, so it’s important to describe the way the lender have a tendency to costs desire to give you an idea of the general cost. Focus on bridging financing was billed in just one of three straight ways: rolled right up, month-to-month otherwise chose.

Folded upwards vs month-to-month

Which have folded right up focus, this new borrower cannot make monthly obligations. The eye was combined monthly in fact it is payable at the end of the term. This is certainly ideal for customers that happen to be unable to build monthly payments since they’re lacking investment up until its log off approach has actually paid.

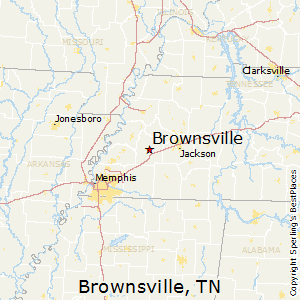

Monthly payments functions in the same way as the a destination-simply home loan the fresh new installment loan lender Central TN debtor potato chips aside at the attract per month and loan amount remains owed towards the bottom.

Retained

The last overall was tallied upwards at first according to the length of the definition of that will be payable at the bottom.

Such as, in the event the debtor desires sign up for ?a hundred,000, the true matter they register for might possibly be a lot more like ?115,100000 which have fees and you will attention evaluated.

How much cash might you use?

Very bridging lenders demand no strict restriction with the number they’re prepared to give. Providing you can also be convince them the hop out strategy is feasible, of a lot bridging organization will believe it is in their attention so you can provide the matter you want, it doesn’t matter how much that may be.

Will there be at least matter?

During the opposite end of the scale, particular lenders get impose at least loan worthy of to be sure the package will probably be worth their if you are. Specific wouldn’t do business if the deal is actually less than ?50,100000 although some may begin your away if it’s significantly less than ?29,100000 but connecting loans, of course, try versatile, so it could be you’ll to get a lender who will approve smaller bridging money than just that.

For the right suggestions about connecting money and also the numbers towards the render, get in touch and you may a whole-of-industry expert tend to assess the job and you may link your on the better lenders.

All of the link financing are provided toward a temporary, interest-simply basis that have regards to one year or quicker given that fundamental. Particular loan providers may be happy to offer so you’re able to ranging from 18 and you can couple of years within the right circumstances, plus the longest label you might discover is three-years.

Assess the month-to-month payments

You can use all of our connecting loan calculator lower than discover an excellent rough concept of simply how much the latest money in your connecting loan are likely to be. Only enter the loan amount, property value and label size and you will the calculator perform the brand new rest. You can put it to use evaluate other interest levels and you can loan-to-well worth rates.

Term lengths

All link money are given to your a temporary, interest-simply foundation having terms of 12 months or less given that simple. Specific loan providers may be prepared to extend so you can between 18 and you will a couple of years within the proper situations, therefore the longest label you might come across was 3 years.

Keep in touch with a bridging Funds expert

We know everybody’s things differ, this is exactly why i run home loans that happen to be specialists in many different home loan sufferers.

Funds for buying property

It’s possible to score a bridging mortgage to shop for belongings, nevertheless might require a professional financial as numerous British connecting money providers wouldn’t give on homes deals because they think them as well risky.

Some of the loan providers that do promote such loans can get inquire one build even more shelter to safeguard the borrowed funds and set rigorous limits into the mortgage so you’re able to worth something ranging from 50-65% is normal. They as well as anticipate one to possess a water-resistant get off means and you may considered permission will also help.