You want two documents because the proof address. These can be a lender report, household bill, council tax bill otherwise credit card statement. Many of these documents have to be old in the last three months – more mature data files will never be recognized.

You can check you to definitely one papers your provide provides the identity spelt truthfully and constantly. Things managed in order to ‘Steven’ as opposed to ‘Stephen’, as an instance, is actually unlikely becoming acknowledged as proof. A similar can be applied for many who altered your surname immediately after engaged and getting married.

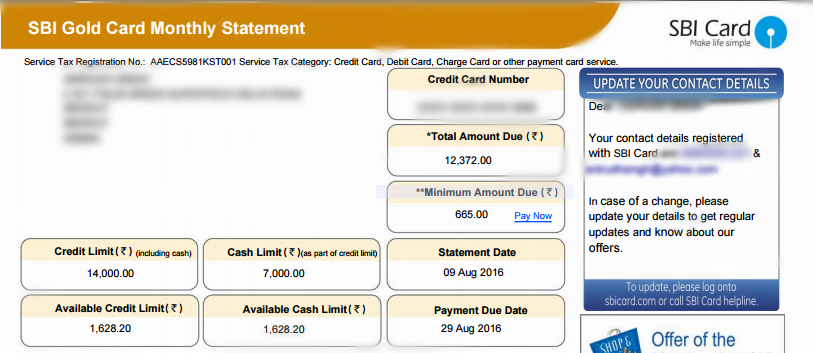

You will need offer information on your own outgoings, having financial and credit card statements in the history around three to half a year, one car finance otherwise hire-purchase preparations, information on any funds, in addition to a list of other typical payments and expense eg travel or childcare.

Your own bank comments must also inform you proof how you’ve dependent enhance deposit. Loan providers can get ask you to identify what they thought is any strange transactions, and you can evidence would be needed to back those people right up. If you are considering the deposit as the a present, you will want a page away from whoever gave you the currency.

While entirely-day a position, you want your own P60 from the manager at least about three months’ worth of payslips.

When you find yourself worry about-operating, it is tribal loan a little more tricky. Typically, you will want specifics of your own tax assessments as well as your account of the past three years, like the latest income tax year.

This could indicate you’re going to have to submit your income tax get back earlier than normal when the, state, you happen to be making an application for a home loan in October however, would not usually submit the go back through to the following January.

To add facts, you want comments out of an accountant, income tax return form SA302, and support pointers instance lender comments and invoices.

- Learn more:mortgage loans having thinking-employed people

Once you’ve located home financing package that meets your needs, you might rating a contract the theory is that, also called a choice in principle otherwise Drop.

Since term implies, it requires a loan provider agreeing ‘in principle’ to give you a great financial, at the mercy of finally inspections and you may acceptance of the house you want to get.

Providing a decision in theory usually comes to a credit check, so we’d recommend simply this when officially trying to get new home loan, or if a home broker asks for you to definitely evaluate you happen to be a reliable consumer.

For those who have the second, you will need to get the choice in theory which have a lender just who operates a softer credit score assessment, because it’s better to contain the number of hard borrowing checks down. The representative helps you with this particular.

For each bank varies, but a decision in theory commonly usually last for six months. In case the property lookup takes more than your planned, you might have to get an alternative choice in principle.

Step 4: Make a formal financial application

The borrowed funds financial will carry out a beneficial valuation with the property you intend to purchase. It confirms in it the property is value roughly just what you wish to shell out the dough.

The lender also create a comprehensive consider of your own files you given along with your credit record. It look will appear in your credit reports.

When the a loan provider transforms your down during this period, it is value trying to find out as to why, and you may possibly wishing a bit before you apply to another financial. Making several financial software really close together you are going to significantly damage your credit history.

Step 5: Watch for their official home loan bring

In the event that a lender are proud of the application, it can make you a formal financial give. Mortgage offers are often appropriate to have half a year, whereas remortgage even offers are usually merely valid for three months (so it may vary anywhere between lenders).